nj property tax relief fund 2020

The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the. This is effected under Palestinian ownership and in accordance with the best European and international standards.

Property Tax Freeze Deadline For Nj Senior Citizens Extended To Feb 1 2021 Camden Nj News Tapinto

98 Unemployment Insurance Tax.

. Early support for the measure is strong. For Tax Year 2021 the income limit for a Retirement Income Exclusion increases to 150000 See Income Exclusions for more information. Temporary exception from excise tax for alcohol used to produce hand sanitizer.

Businesses that are comparing states. IRS Provides Penalty Relief for Certain 2019 and 2020 Returns - Must File by September 30. A contractors bill should separately state the charges for materials and for labor.

It is paid by delay meaning the latest year was 2017 but unfortunately that deadline December 2019. The Homestead Rebate provides property tax relief to eligible homeowners Sarnecki said. A lot of voters agree with us.

To protect the public and employees and in compliance with orders of local health authorities around the country certain IRS services such as live assistance on telephones. By working closely with the Senate President and the Speaker we were able to fully fund the program in its first year allowing us to provide. This improves the explanatory power of the State Business Tax Climate Index as a whole because components with higher standard deviations are those areas of tax law where some states have significant competitive advantages.

New Jersey is a state in the Mid-Atlantic and Northeastern regions of the United States. Eight states impose no state income tax and a ninth New. - 130 pm 20 of sales at the Sunrise Bagel Shop in Wyckoff will be donated to MetaVivor Breast Cancer Fund.

Modifications of limitation on business interest. Modification of credit for prior year minimum tax liability of corporations. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms.

The contractor charges Sales Tax on the labor. Or installation service to real property sales tax must be collected from the customer. The ANCHOR program will deliver real tangible property tax relief to both homeowners and renters a historic step toward making New Jersey a more affordable state said Governor Phil Murphy.

Transfers from the general fund of the Treasury to specified Social Security trust funds are authorized to cover any loss in revenue due to the employer retention tax credit. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. It is bordered on the north and east by the state of New York.

The Internal Revenue Service reminds taxpayers and tax professionals to use electronic options to support social distancing and speed the processing of tax returns refunds and payments. NJ sales tax home improvement. B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which employs not.

Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their employees. Some local governments also impose an income tax often based on state income tax calculations. States collect a state income tax.

Our experienced journalists want to glorify God in what we do. 150 Property Tax. By law some payroll taxes are the responsibility of the employee and others fall on the employer but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction and falls.

Meals on Wheels in New Jersey Fund - Beginning with the 2021 NJ-1040 you can make a donation to the Meals on Wheels in New Jersey Fund using code 29 on lines 73-75 of the return. Forty-two states and many localities in the United States impose an income tax on individuals. On the east southeast and south by the Atlantic Ocean.

Saving up an emergency fund has long been a personal finance building block with experts recommending that people keep anywhere from 3 to 12. 2302 This section allows employers to delay payment of. Oct 28 World of Pink Foundation working to help support.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. This Sunday from 730 am.

Technical amendments regarding qualified improvement property. And on the southwest by Delaware Bay and the state of DelawareAt 7354 square miles 19050 km 2 New Jersey is. What started with good policy created by a diverse group of organizations including the Natural Resources Defense Council the American Lung Association California State Firefighters the Coalition for Clean Air the State Association of Electrical Workers IBEW the San Francisco Bay Area Planning and.

A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Scottish perspective on news sport business lifestyle food and drink and more from Scotlands national newspaper The Scotsman.

Payne PE PS Kevin - Right of Way Survey GISProject Manager. There shall be annually credited from the General Fund and placed in a special account in the perpetual Property Tax Relief Fund established pursuant to this paragraph which account shall be designated the Property Tax Reform Account an amount equal to the annual revenue derived from a tax rate of 05 imposed under the Sales and Use Tax Act. Further the division establishes new tax provisions such as 1 setting a minimum rate for the low-income housing tax credit 2 specifying that waste energy recovery property ie property that generates electricity solely from heat from buildings or equipment where the primary purpose of the building or equipment is not electricity.

On the west by the Delaware River and Pennsylvania. 211 Corporate Tax. In addition to federal income tax collected by the United States most individual US.

The Official Website Of City Of Bayonne Nj Tax Collection

News Borough Of Lodi New Jersey

Murphy Announces New Property Tax Relief Program Whyy

Tax Collector Woodbridge Township Nj

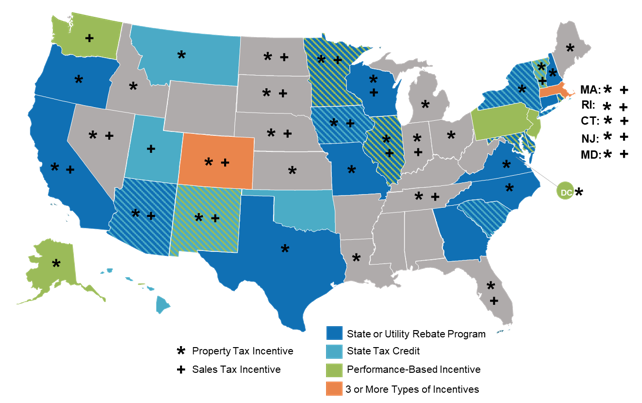

Where Are Solar Pv Incentives In 2020 Dsire Insight

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Nj Property Tax Relief Plan Could Give Homeowners 700 Rebates

Nj Property Tax Relief Program Updates Access Wealth

![]()

News Announcements Township Of Little Falls

Property Tax Relief Still Available For Manchester Seniors Manchester Nj Patch

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Tax Finance Dept Sparta Township New Jersey

Gov Murphy Unveils Anchor Property Tax Relief Program Whyy

N J Tax Breaks Coming Thanks To Huge Surplus Murphy And Top Dems Announce Nj Com

Nj Anchor Property Tax Relief Program Replaces Homestead Benefit Middlesex Borough

New Initiative Makes Over 1 Million More New Jersey Households Eligible For Property Tax Relief Program The Lakewood Scoop