child tax credit september 2021 payment

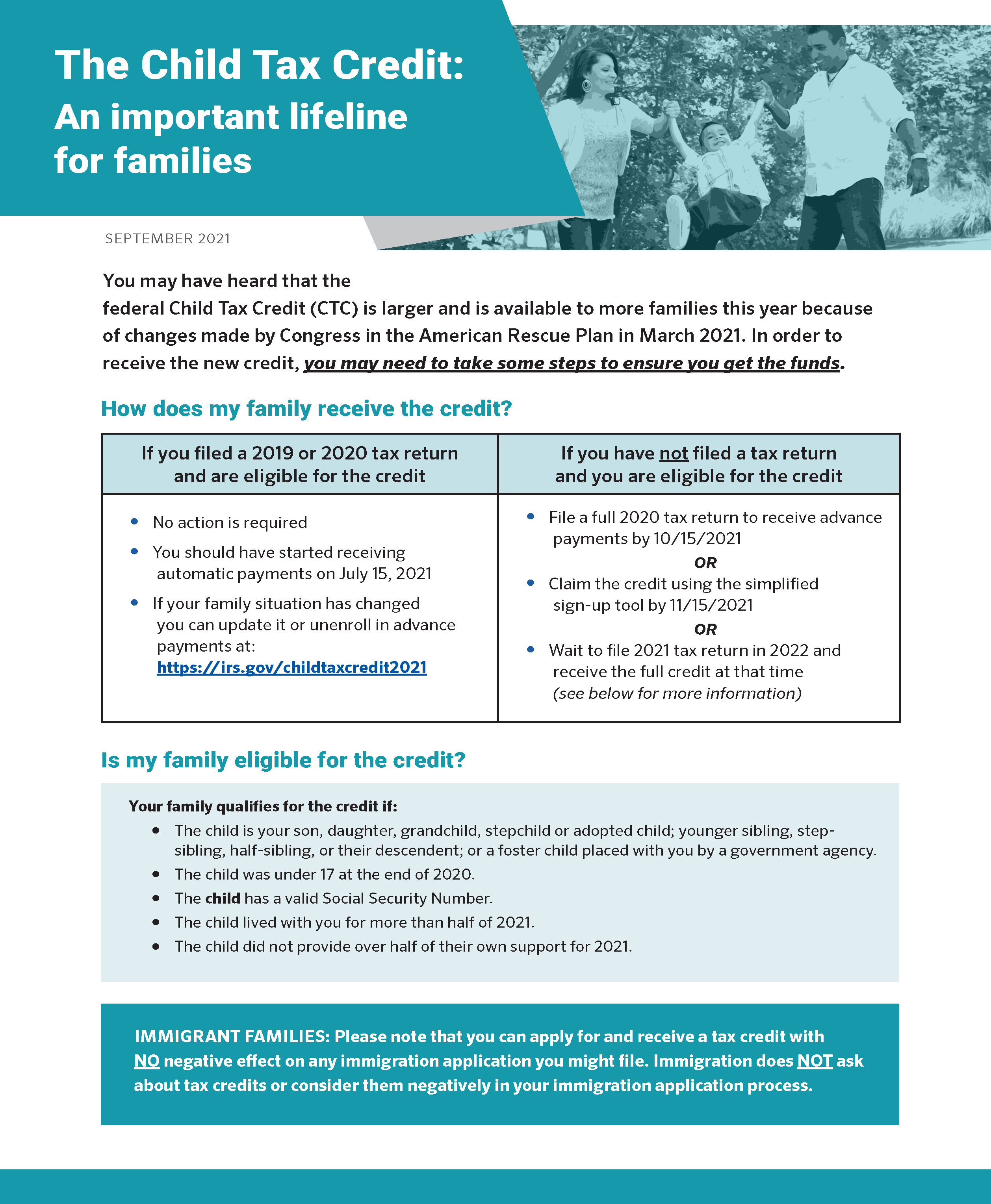

The next child tax credit payments will start arriving on September 15. Parents in September will receive up to 300 for each child five and under and 250 per kid six to 17.

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

If you get your payments in the form of a papercheck.

. Up to 3600 per child or up to 1800 per child if you received. 15 July Age of Child in 2021 Monthly Payment July-December 2021 Lump-Sum Payment 2022 Tax. Parents with children from ages 6-17 are eligible for up to 3000 per child or 250 per.

September 16 2021 735 AM MoneyWatch. How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx The credit. The credits scope has been expanded.

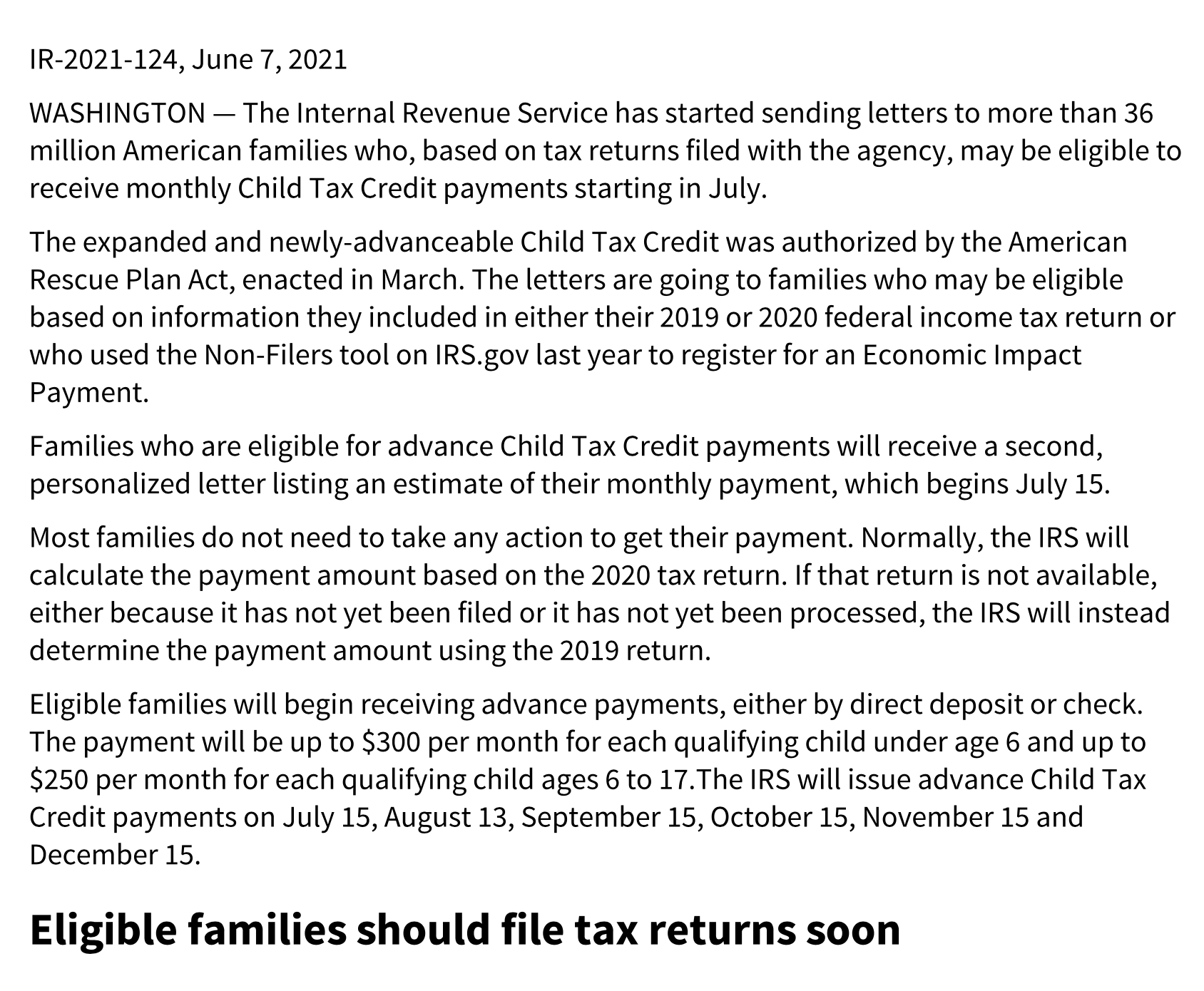

How much money you could be getting from child tax credit and stimulus payments. September 17 2021. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers.

Goods and services tax harmonized sales tax GSTHST credit. The second half will come when families file. So each month through December parents of a younger child are receiving 300 and.

Some parents still havent received the September child tax credit payment. Your check amount will be based on your 2021 Empire State child credit your New York State earned income credit or noncustodial parent earned income credit or both. Wait 5 working days from the payment date to contact us.

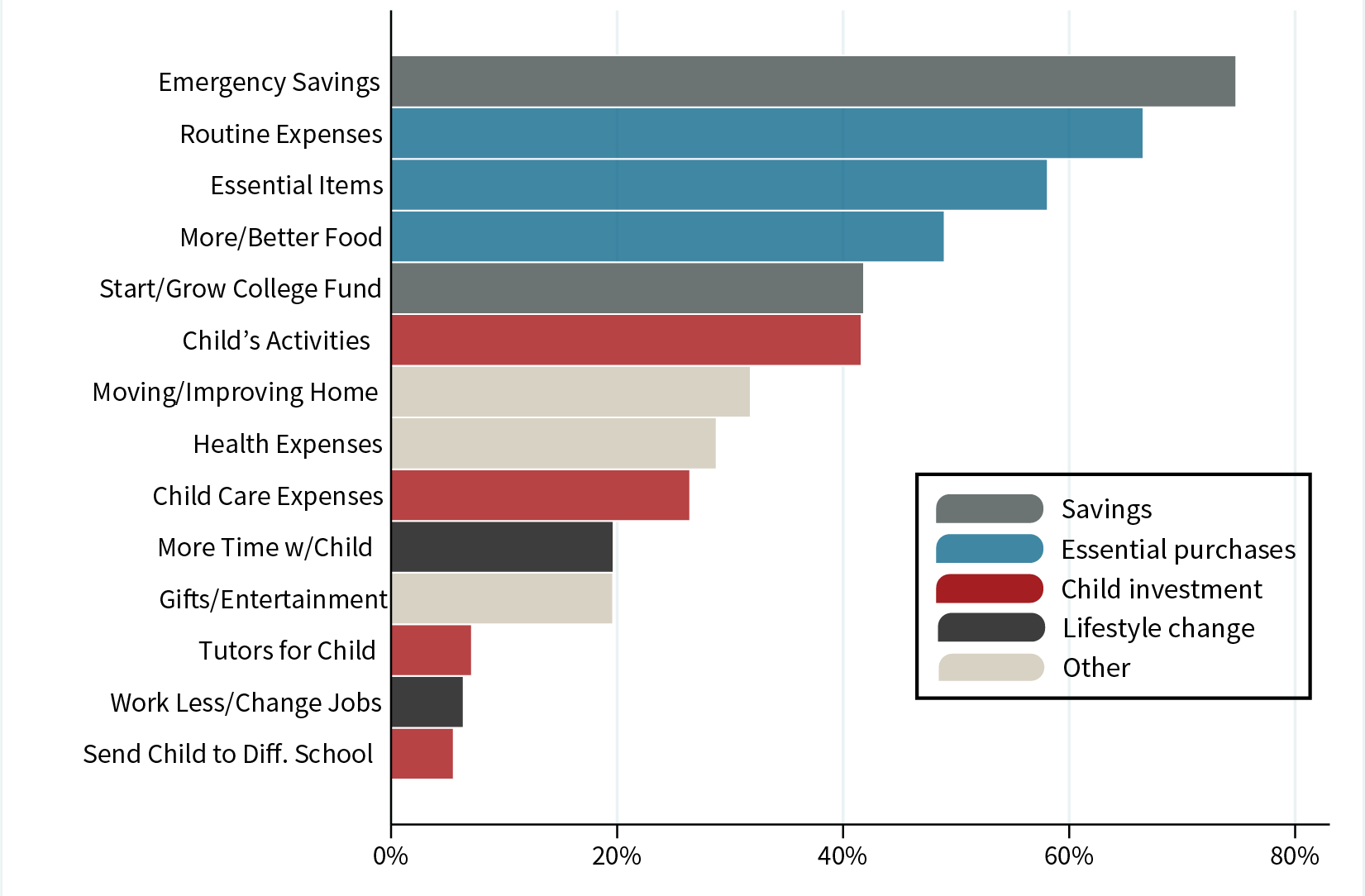

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. That includes stimulus checks of 1400 per person child. For 2021 the credit amount is.

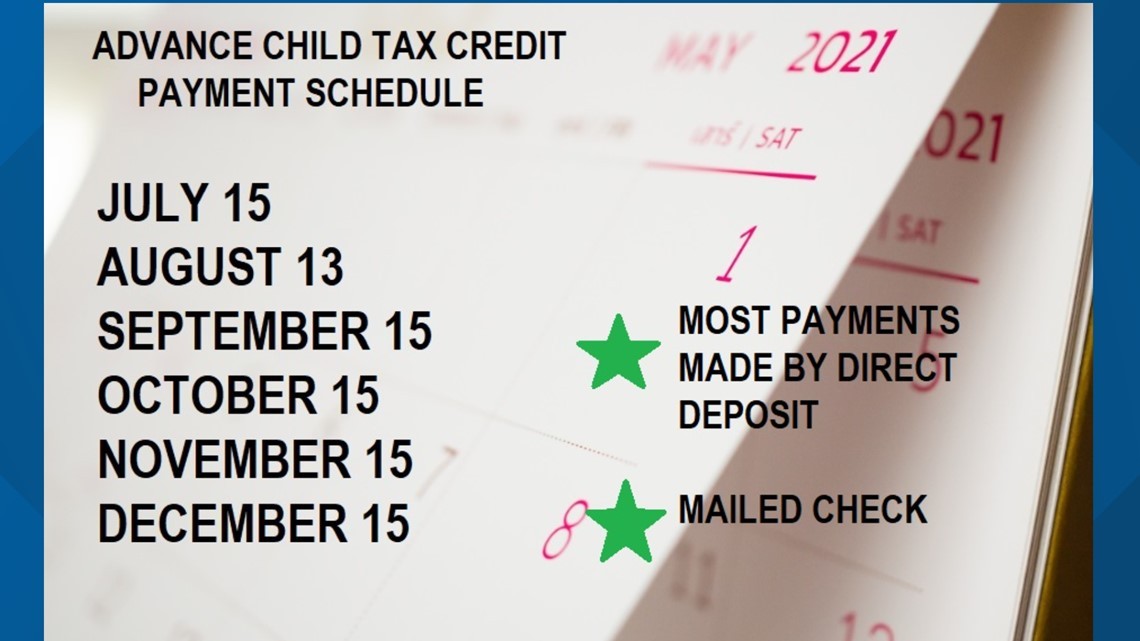

Well tell you when this payment will arrive and how to unenroll. Only one child tax credit payment is left this year. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Millions of families across the US will be receiving their third advance child tax credit. This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. Enhanced child tax credit.

Previously only children 16 and younger qualified. Determine if you are eligible and how to get paid. Parents with children under age 6 are eligible for up to 3600 per child or 300 per month.

To unenroll from advance payments use the IRS Child Tax Credit Update Portal at irsgov. 2 days agoThe more generous credits were authorized through the American Rescue Plan Act which was enacted in March 2021. Updated 714 PM EDT Fri.

The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Half of the total is being paid as six monthly payments and half as a 2021 tax credit. The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of.

Of families will receive. Though the Internal Revenue Service sent out the third monthly child tax credit payment last week some families are still waiting for the funds. 您在 2021 年是否有領取預付款項但想要取消註冊 若要取消註冊請造訪 irsgov 以使用 IRS Child Tax Credit Update Portal 2021 年 的子女年齡 2021 年預付款項 2022 年退税 兩筆款項.

Includes related provincial and territorial programs. Published Wed Sep 22 2021 1232 PM EDT. Subsequent stimulus checks will be sent to households on October 15 November 15 and December 15.

Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

How Can I Enroll A Child Born In 2021 For The Child Tax Credit Payments As Usa

The New Child Tax Credit Does More Than Just Cut Poverty

Child Tax Credit How To Track Sep 15 Payment What To Do If Previous One Is Missing

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Payment Dates September 2021 When Do Payments Come This Month The Us Sun

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Child Tax Credit Mystery Parents Report No September Check

Virtual Information Session About The Advance Child Tax Credit Office Of The Queens Borough President

Irs Sending Letters To More Than 36 Million Families Who May Qualify For Monthly Child Tax Credits Payments Started July 15 Children Youth News Coconino Coalition For Children Youth

The Child Tax Credit An Important Lifeline For Families North Carolina Justice Center

Advance Child Tax Credit Payments Begin July 15

Tax Tip Update Your Address By August 30 For September Advance Child Tax Credit Payments

All You Need To Know About The New Child Tax Credit Change

Is Your September Stimulus Child Tax Credit Payment Delayed Report Outlines What You Need To Know Silive Com

Total Covid Relief 60 000 In Benefits To Many Unemployed Families

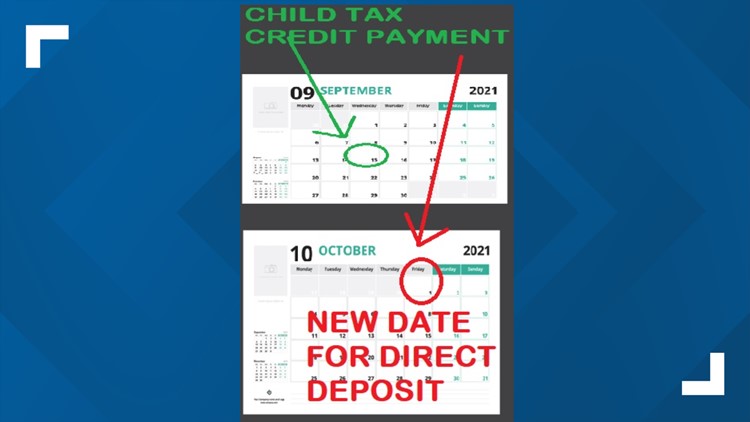

Irs Delays Some September Child Tax Credit Payments Until Oct Wfmynews2 Com

Child Tax Credit How To Track Your September Payment Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities